Tax planning advice

Get expert advice on tax planning strategies to maximize deductions and credits and minimize taxes.

2 of 5 pillars

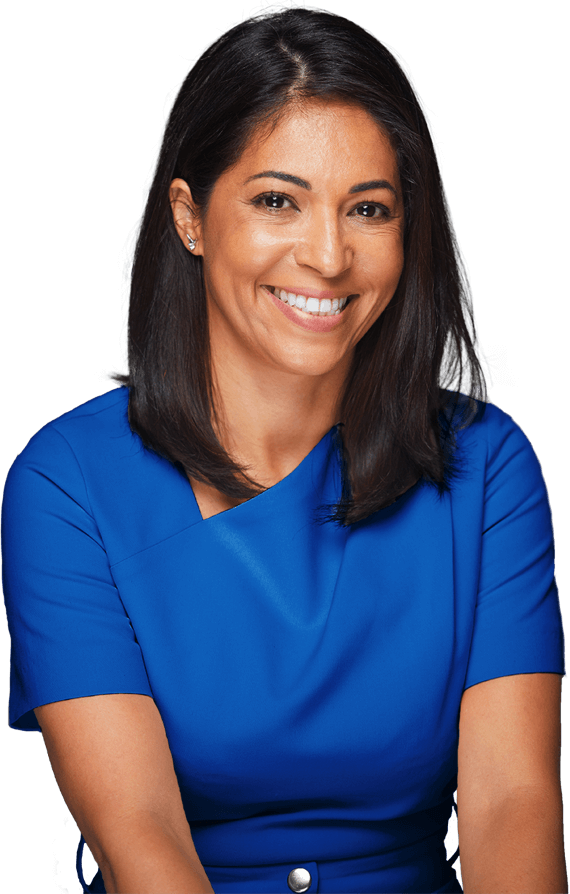

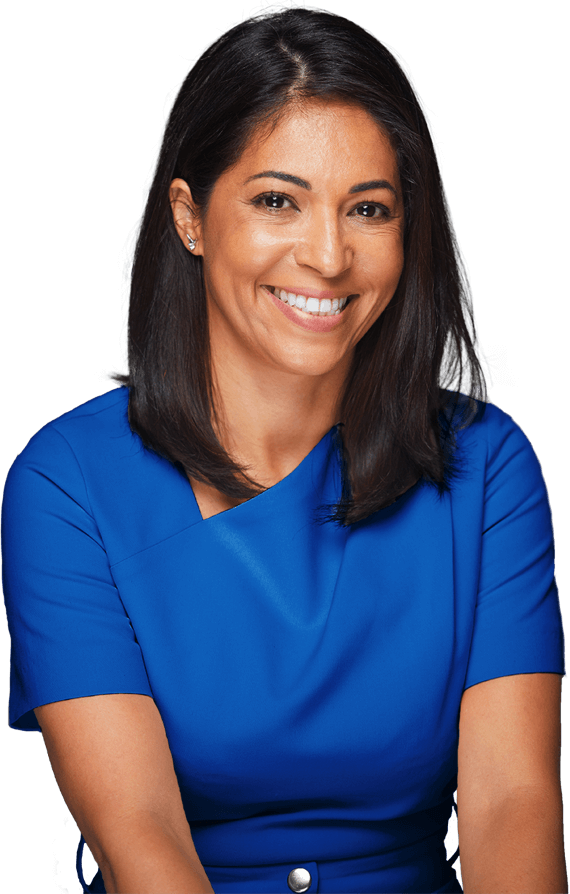

Speak to an IG Advisor today.

Preparing for the Unexpected

100

You’ve taken measures to protect your finances from an unexpected event, but it’s important to regularly monitor your insurance and emergency funding needs, which will change as your life evolves. For instance, the life insurance you bought at age 30 may not be enough to protect your family at age 45, when you’re now earning more money. Also review your will, power of attorney and beneficiary designations to ensure you have the right people looking after your financial affairs. An advisor can help determine if you have the right plan in place.

See less

Sharing Your Wealth

Managing Your Cash Flow Efficiently

Planning for Major Expenditures

Now that you have your IG Living Plan Snapshot, talk to your IG Consultant about your IG Living Plan and how you can work together to improve your financial well-being.